How to Become an Insurance Broker in Nevada

|

1. Decide which type of insurance producer you will be.

There are several lines, or types, of insurance. Some brokers specialize in one type, while others prefer to offer all lines. The most common lines are Property & Casualty (P&C) and Life & Health (L&H). One factor that may determine this choice is whether you are going to be appointed with a captive agency or non-captive agency. If you choose a captive agency, they will dictate exactly which lines of insurance you are allowed to sell when appointed with them. If you select a non-captive agency, you are free to choose which lines and even specific insurance products to offer your clients. |

Either way, both require training and licensing to operate as an insurance agent in the State of Nevada.

|

2. Pre-license Education

...candidates must satisfactorily complete an approved course of education in the fields of insurance for which they apply before they may be licensed. Candidates must satisfactorily complete twenty (20) hours of education per line of authority. -Nevada Division of Insurance This means that for each type of insurance you want to sell, you must complete state required hours of pre-licensing education. Upon successful completion of courses you will receive a certificate from the accredited institution. You will need to keep this certificate as proof that you are qualified to take the state exam.

There are various types of training available to accommodate any learning style or preference, including: online classes, classrooms, and self-study. The cost of education varies depending on how you choose to learn and from whom. The average range is $100-$400 |

3. Nevada State Licensing

|

Licensing exams are proctored by Pearson VUE. All candidates test in a controlled environment with a person and cameras watching. Tests last for several hours and notes are not allowed.Most online courses include practice exams that can be taken repeatedly.

Depending on the length of your pre-license courses, you may want to do this step first. Sometimes, it can take over 2 weeks to get an appointment to take the state exam. Payment will be expected at time of reservation. The fee for each attempt of the exams is $61. |

Schedule your Exam:

|

Additional Licensing Requirements

|

Fingerprint & Criminal History

|

Apply for your license

The National Insurance Producer Registry facilitates state licensing. You can track your application process, renew, and refer to their website for ongoing compliance and standards.

Click logo to visit NIPR website: |

|

4. Errors and Omissions Insurance Errors and Omissions Insurance, or E & O coverage, shields your business from financial risk in the event of professional errors or accusations that your work was inadequate, unprofessional, or incomplete. In a nutshell, E & O Insurance protects you if clients claim you made mistakes that cost them money. E & O premiums vary, but an independent agent can cover themselves for as a low as $30 per month. |

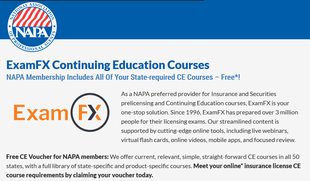

NAPA members get FREE CE with ExamFX:

|

5. U.S. Anti-Money Laundering (AML) Training

|

LIMRA's U.S. Anti-Money Laundering Training Program is a fast, easy, and inexpensive way for financial services companies to meet key requirements of U.S. Treasury Department rules.

This industry-wide training program allows producers to complete core training just once, and documentation is sent to every carrier they represent. |

Click Image to go to website

|

Line-Specific Requirements

Each line of insurance may have additional requirements. For instance, financial products require securities licensing and Medicare products require AHIP training. For line-specific requirements, administrators are available to assist you.